Maternity capital is one of the state support measures aimed at increasing the birth rate. This money can be used for one or more purposes at the same time.

General procedure for the use of maternity capital

Maternity capital can be used exclusively for the following purposes (part 3 of article 7 of the Law of December 29, 2006 N 256-FZ):

- improvement of living conditions on the territory of the Russian Federation;

- receiving education by the child (children);

- formation of a funded pension;

- purchase of goods and services intended for social adaptation and integration into society of children with disabilities.

Start using maternal capital can be no earlier than three years from the date of birth or adoption of the second, third child or subsequent children. An exception is cases when maternity capital funds are used to pay the down payment and (or) repay the principal debt and pay interest on loans (loans) taken for the purchase and construction of housing, as well as for the purchase of goods and services intended for social adaptation and integration in the community of children with disabilities. In such a situation, you can use maternity capital immediately after the birth of a child, without waiting for him to reach the age of three (parts 6, 6.1, article 7 of Law N 256-FZ).

At the same time, the use of maternity capital funds to pay off the principal debt under a sale and purchase agreement before the child reaches three years of age is unacceptable (clause 4 of the Review, approved by the Presidium of the Supreme Court of the Russian Federation on 06/22/2016).

There are no other restrictions on the terms of use of maternity capital. The owner of the certificate can use it at any time at their discretion.

Maternity capital can be spent simultaneously for several purposes (part 4 of article 7 of Law N 256-FZ). For example, part of the funds is allowed to be spent on improving housing conditions, and part on education for the child.

Note!

Maternity capital as a measure of state support of a targeted nature is not part of the joint property of the spouses, and therefore is not subject to division in the event of divorce ( paragraph 2 of Art. 34, Art. 38 RF IC; item 1 Letters of the FNP dated 01.07.2016 N 2305/03-16-3).

Example. Certificate for maternity capital received before the dissolution of the marriage

The couple, having two minor children, divorced in court. By order of the court, children must live with their father. At the same time, the mother of the children has a certificate for maternity capital received before the divorce. This certificate must remain with the mother. The legislation does not provide for the division of the certificate between spouses.

For the disposal of maternity capital, the following documents are submitted to the territorial body of the PFR (clause 2, Rules, approved by Order of the Ministry of Labor of Russia dated 08/02/2017 N 606n; clause 6, Rules, approved by Decree of the Government of the Russian Federation dated 12/12/2007 N 862):

- a written statement on the disposal of maternity capital;

- identity documents, place of residence (stay) of the certificate holder or representative of the certificate holder and a document confirming his authority;

- if necessary: identity documents of the spouse of the certificate holder, documents confirming the relationship of family members of the certificate holder (in particular, a marriage certificate), as well as permission from the guardianship and guardianship authority to spend maternity capital funds in selected areas, if an application for disposal is submitted guardians (custodians) or adoptive parents of minor children, documents confirming the acquisition by a minor child (children) of full legal capacity, if the application is submitted by a minor child (children).

Note. When applying for the disposal of maternity capital, we also recommend that you also have birth certificates of children with you.

In addition to the above documents, depending on the chosen direction of spending funds, documents confirming the purpose of using maternity capital will be required.

An application for disposal can be submitted / sent to the territorial body of the PFR (clause 6, - Rules N 606n):

- personally or through a representative (at the place of residence / stay or actual residence);

- by mail;

- through the MFC;

- in the form of an electronic document.

In the first three cases, the required documents are attached to the application. In the latter case, the application is sent to the territorial body of the PFR in the form of an electronic document through the Unified Portal of State and Municipal Services or information system FIU " Personal Area insured person." Then the FIU official sends the applicant an electronic notification of receipt of his application indicating the date of submission of the necessary documents to the FIU. The term for their submission should not exceed five working days from the date of receipt of the application by the FIU.

Note. Applicants who have left for a permanent place of residence outside the Russian Federation and do not have a place of residence (stay) confirmed by registration on the territory of the Russian Federation, submit an application directly to the FIU and submit an application about the place of their actual residence on the territory of the Russian Federation ( Clause 7 of Rules N 606n).

The application for disposal is considered by the territorial bodies of the PFR within a month from the date of receipt of the application with all necessary documents. Based on the results of the consideration, a decision is made to satisfy or refuse to satisfy the application, of which you will be notified within five days from the date of the decision. With a positive decision, the money must be transferred to the chosen goal within 10 working days from the date of the decision to satisfy the application (parts 1, 3 of article 8 of Law N 256-FZ; clause 17 of Rules N 862; clause 9 of the Rules, approved Decree of the Government of the Russian Federation of December 24, 2007 N 926).

Note!

The use of maternity capital in various illegal schemes for the purpose of cashing out funds and their misuse (for example, for the purchase of a car, furniture, etc.) may result in the requirements of the PFR authorities to return the corresponding amounts. If the actions of the certificate holder are recognized as fraud, criminal liability is provided in the form of: a fine, or compulsory (corrective, forced) labor, or arrest. It is also possible to be punished in the form of restriction or imprisonment ( Art. 159.2 Criminal Code of the Russian Federation). However, under certain circumstances, the court may exempt from criminal liability ( Art. 76.2 of the Criminal Code of the Russian Federation).

Improving housing conditions in the Russian Federation at the expense of maternity capital

The law refers to the improvement of living conditions for which maternity capital can be used in the following cases (Article 10 of Law N 256-FZ; clause 8 of Rules N 862):

1) acquisition of residential premises;

2) construction of residential premises with the involvement of a construction organization;

3) construction or reconstruction of an individual housing construction facility without the involvement of a contractor;

4) compensation of costs for the construction or reconstruction of an object of individual housing construction (IZhS);

5) payment of a down payment upon receipt of a credit or loan, including a mortgage, for the purchase or construction of housing;

6) repayment of the principal debt and payment of interest on credits or loans, including mortgages, for the purchase or construction of housing;

7) payment for participation in shared construction;

8) payment of an entrance fee as a member of housing, housing construction, housing savings cooperatives, etc.

Note!

Acquired (constructed, reconstructed) residential premises using maternity capital funds must be registered in the common ownership of the certificate holder, his spouse, children (including the first, second, third child and subsequent children) with the determination of the size of the shares by agreement. The legitimacy of a housing purchase and sale transaction using maternity capital funds, as a result of which only the children of the certificate holder become homeowners, may be questioned ( Letter FNP dated 07.02.2013 N 216/06-11).

At the same time, a real estate object that is not completed and not put into operation must be registered in the common shared ownership of the certificate holder, his spouse, children ( item 5 Review, approved. Presidium of the Supreme Court of the Russian Federation on July 6, 2016).

To use maternity capital for the above purposes, in addition to the standard set, you will need to submit an additional set of documents to the territorial branch of the PFR, which will depend on the type of housing improvement you have chosen (clause 8 -, -, - Rules N 862).

Getting education by a child (children) at the expense of maternity capital

Maternity capital can be used to pay for the education of the child (children), including the first, second, third child and (or) subsequent children, in educational organizations in the Russian Federation that have a license and state accreditation. You can pay for the education of both native and adopted child provided that at the date of commencement of education, the age of the child does not exceed 25 years (parts 2, 3 of article 11 of Law N 256-FZ).

Maternity capital funds can be used to pay for the maintenance of the child and (or) supervision and care of him in an educational organization preschool education and (or) primary general, basic general and secondary general education (clause 8(1) of Regulation N 926). You can also pay for accommodation and utilities in a hostel provided to non-residents for the period of study (clause 6 of Rules N 926).

To use maternity capital for the education of children, in addition to the standard set, depending on the type of educational services you have chosen, you must submit to the territorial branch of the PFR:

- documents confirming the purpose of using the maternity capital to pay for the hostel and utilities in a hostel (clause 7 of Rules N 926);

- an agreement between the educational organization and the owner of the certificate, including the calculation of the amount of the fee and the organization's obligations to support the child and (or) look after and care for him (clause 8 (2) of Rules N 926).

Note. It is also recommended that the contract indicate the amount of funds directed by the PFR authorities to pay for the maintenance of a child in an educational organization, the period for sending funds and the possibility of returning unused funds by the educational organization to the territorial bodies of the PFR in case of termination or expiration of the contract ( Letter PFR and the Ministry of Education and Science of Russia dated 01.27.2012 N N LCH-28-24 / 843, MD-36/03).

Formation of a funded pension at the expense of maternity capital

Maternity capital can be directed to the formation of a funded pension. This purpose of using maternity capital must be indicated in the application submitted to the territorial body of the PFR. Only mothers or adoptive parents can use maternity capital in this way (part 1 of article 12 of Law N 256-FZ).

Note!

Until the day of the appointment of a funded pension, you can refuse to use maternity capital funds in the indicated direction and direct them to other purposes provided for by law ( Part 2 Art. 12 of Law N 256-FZ).

If, at the time of assigning a funded pension, a woman did not manage to dispose of maternity capital, then when assigning a funded pension, she has the right to take into account maternity capital funds as part of pension savings ( Part 5 Art. 12 of Law N 256-FZ).

Acquisition of goods and services for disabled children at the expense of maternity capital

Maternity capital can be used to purchase goods and services approved for circulation on the territory of the Russian Federation, intended for social adaptation and integration into society of disabled children, in accordance with an individual rehabilitation program. The use of maternity capital funds is carried out by compensating for the costs of acquiring these goods and services (clause 4 of the Rules, approved by Decree of the Government of the Russian Federation of April 30, 2016 N 380).

Documents confirming the purchase of goods include sales contracts, sales or cash receipts or other documents confirming payment. The presence of the purchased goods is confirmed by an act drawn up by an authorized body in the field of social service. The purchase of services is confirmed by an agreement on their provision (parts 2, 3, article 11.1 of Law N 256-FZ).

According to statistics, only 54.6% of citizens who issued a certificate for maternity capital applied for its use. The rest of the families are still thinking about what they can spend their maternity capital on.

The fact is that budgetary funds are allowed to be used only in certain areas. Let's take a look at what it is allowed to invest in, and which areas are non-targeted in 2019.

The legislative framework

The program has been operating since 2007. It was approved by the Federal Law of December 29, 2006 No. 256-FZ. The text of this document explains how to use maternity capital. In addition, the following changes were made to the law:

- In 2011, the legislator allowed the use of the certificate for the construction (reconstruction) of a residential building with their own hands.

- 2015 brought changes related to the removal of restrictions on spending budget funds in order to ensure the initial mortgage payment. Now the certificate can be sent to the bank immediately after receipt.

- In 2016, it is allowed to use funds for the rehabilitation of disabled children.

- From 01/01/2018, it is possible to issue monthly payments for the 2nd child until he turns 1.5 years old.

The main conditions for attracting budget money, laid down in the legislation, look like this:

The main conditions for attracting budget money, laid down in the legislation, look like this:

- it is allowed to use the funds both in full at once, and in parts;

- the owner makes the distribution in the application form (through the local authority of the Pension Fund of Russia - PFR);

- the allocation of money from the budget is carried out exclusively in a non-cash format;

- basically, it is allowed to apply for funds after the child's 3rd birthday (except for paying off a mortgage loan).

The main limitation is the young person reaching the age of 25.

Where is it allowed to send mother capital in 2019

Due to the fact that the legislation is constantly being improved, in 2016 the purposes of using the certificate expanded. State aid could be invested in four different directions. This rule also applies in 2019.

In addition, the owner of the certificate is not forbidden to spend money in installments in different areas defined by law. These currently include:

- improving the living conditions of the family;

- payment for services of educational institutions (for any child);

- contribution to the accumulative pension fund for the mother;

- compensation for the acquisition of rehabilitation equipment for disabled children (any child).

On the lump-sum payment of part of the mother's capital

Back in 2009, the legislator provided certificate holders with an official opportunity to cash out some funds from the certificate. In 2019 this law is no longer valid. To receive 25 thousand rubles. I had to go to the FIU with an application.

The money was allowed to be spent on urgent needs, that is, the legislator did not determine the goals for them. However, some restrictions were introduced. These included the following rules:

- payment was allowed to be received only once;

- it was considered anti-crisis and transferred to the account of the owner of the certificate;

- it was allowed to apply for money until the child was three years old.

Do you need on the subject? and our lawyers will contact you shortly.

Capital for housing

Most citizens, arguing how to use capital from the state, choose to spend on housing.

Most citizens, arguing how to use capital from the state, choose to spend on housing.

At the same time, mother's money is allowed to invest:

- in the construction of new buildings, including joint efforts (housing cooperative);

- reconstruction of premises, which implies a change in their intended use;

- payment of the first mortgage installment;

- reimbursement of interest on a housing loan;

- repayment of existing mortgage debt (principal, not including penalties);

- acquisition of a part of the residential premises (allocated share).

Investing in children's education

In 2019, an order for the use of mother's capital is allowed to be submitted in order to pay for tuition and related services. At the same time, it does not matter for the education of which of the children the budget money is directed (according to the account, according to the degree of kinship).

In 2019, an order for the use of mother's capital is allowed to be submitted in order to pay for tuition and related services. At the same time, it does not matter for the education of which of the children the budget money is directed (according to the account, according to the degree of kinship).

The following conditions for spending funds are mandatory:

- educational institution must have state accreditation;

- it is allowed to choose only an institution located within the state borders of Russia;

- a novice student should not be more than 25 years old (it is not necessary to enter a paid university immediately after graduation).

In addition, family capital funds can be used to pay for visits by children:

- sports schools and sections;

- musical and art educational institutions;

- foreign language courses.

Kindergarten payment

Many mothers who choose how to implement maternity capital are attracted by the opportunity to pay for their children to visit a good private kindergarten.

Many mothers who choose how to implement maternity capital are attracted by the opportunity to pay for their children to visit a good private kindergarten.

This possibility is spelled out in the government decree of November 14, 2011 931. To implement it, the following conditions must be met:

- make sure the preschool is licensed;

- carries out its activities on the territory of the country;

- conclude an agreement corresponding to the established model;

- highlight in it the price of services for the maintenance of the child:

- nutrition;

- upbringing;

- socialization;

- ensuring hygiene standards.

Mom's pension

The entire amount of state support or only a part can be invested in old age, that is, directed to pensions. This method of spending mother capital is the least popular at the present time. In the case of its implementation, the money will be received:

The entire amount of state support or only a part can be invested in old age, that is, directed to pensions. This method of spending mother capital is the least popular at the present time. In the case of its implementation, the money will be received:

- at the same time;

- as urgent payments (at least 10 years);

- for life in equal shares after reaching the appropriate age.

Where it is not allowed to spend family funds

In society, there is a constant discussion of other areas for investing mother capital. Almost half of the certificate holders have not decided where to spend state aid. Citizens are not satisfied with the directions defined in the current legislation. Thus, proposals are made to include in the list of permitted purposes:

In society, there is a constant discussion of other areas for investing mother capital. Almost half of the certificate holders have not decided where to spend state aid. Citizens are not satisfied with the directions defined in the current legislation. Thus, proposals are made to include in the list of permitted purposes:

- purchase of vehicles;

- investment of public money in the cottage;

- acquisition of land;

- compensation for the cost of repairing the apartment;

- payment of a consumer loan.

Some of the announced proposals were also discussed in the State Duma. Thus, since 2009, draft amendments to the law of December 29, 2006 No. 256-FZ are regularly submitted to the legislature, which provides for the purchase of a car for transporting passengers using a certificate.

Important! All of the above methods of using mother capital prohibited by law.

In addition, there are other restrictions on the investment of public money included in the budget for the payment of state support to families with children. So, it is forbidden for them to repay the loan debt formed from penalties.

How to spend maternity capital funds

In order to dispose of state aid, you must contact the local branch of the FIU. The owner of the certificate must do this by providing the following documents:

In order to dispose of state aid, you must contact the local branch of the FIU. The owner of the certificate must do this by providing the following documents:

- certificate (original);

- identity card (copy of passport);

- SNILS.

In addition, you need to fill out an application for the disposal of family (maternity) capital. This is a form of the established form, in which the intended purpose of spending is indicated without fail.

The decision to approve and transfer money is made by the PFR specialists within 2 months. Therefore, recipients need to be warned about the delay.

Important! Applications for the disposal of money under the certificate are allowed to be submitted as many as required. If a citizen changes his mind about spending some part of state aid, he should write an application to cancel the previous one.

The package of documents for the disposal of mother capital includes papers justifying its intended use. They are described in government regulations:

- No. 862 dated 12/12/2007 - for housing;

- No. 926 24.12.2007 - for educational services.

Which direction of investment to choose

The holders of the certificate will have to decide on the spending of the money allocated from the state. The legislator does not limit citizens in the terms and choice of goals laid down in the legislation:

The holders of the certificate will have to decide on the spending of the money allocated from the state. The legislator does not limit citizens in the terms and choice of goals laid down in the legislation:

- family capital can be used even after the end of the program, that is, the certificate will not be lost;

- if the owner does not choose how to invest, they will automatically be attracted to his pension provision after reaching the required age.

Dear readers!

We describe typical ways to resolve legal issues, but each case is unique and requires individual legal assistance.

For a prompt resolution of your problem, we recommend contacting qualified lawyers of our site.

Regional capital differs from the state capital in size and terms of receipt. In many regions, the subsidy is issued only at the birth of a third child, in addition, there are requirements for family income or residence time in the territory of the subject. Methods of spending may be different, some regions provide the opportunity to buy a car, others allow spending money only on improving living conditions.

The federal program to increase the birth rate has been operating in the country for 10 years. In addition to it, each region has introduced its own measures to support families with children. However, if the state allocates funds strictly at the birth of the second or subsequent children, then the subjects can establish their own rules.

Maternity capital or regional capital is a family support measure implemented by regional authorities, which serves as an addition to a similar state program.

Regional option of maternity capital

The right of the region to issue its own regulations is implemented in different ways: for example, in Dagestan, the amount of payment is established by decree, in the Rostov region - by law, in the Leningrad and Belgorod regions - by the social code. Therefore, the name of the documents will be different.

Creating their own areas of support for families, the regions proceed from their financial capabilities, because the incomes of different entities are very different from each other. There are also regions that cannot fully cover their expenses from income, so they are allocated subsidies.

In addition to the amount of the subsidy paid to families, the regional authorities determine the conditions for its provision, the procedure and directions for spending. There are also many differences in this regard. This is especially true for the order of use: in some regions, you can get money when the child reaches the age of one and a half, and not three years.

Regarding the number of children in the family, one can state almost complete unanimity: most regions pay money for the third child, rarely for the second.

Note! In addition to regional maternity capital, there are other measures to support large families in the regions.

What is the difference between regional capital and state capital?

The maternity capital given to families by the state and the region is different. These are two complementary programs that cannot be interchanged:

- The difference lies in the source of funds and the amount. For the federal family support program, money is allocated from the country's budget, and for the regional program - from the budget of a particular region. The amounts also differ: the state allocates 453,026 rubles, the regions are several times less. Basically, the amount of payment of the subject is no more than 100 thousand rubles.

- Directions for spending funds. If we talk about family capital allocated by the state, then they are determined by federal law. With regard to regional assistance, such directions are determined by the subjects themselves and can be supplemented or reduced. For example, in some regions, the funds received can be spent on gas, electricity, water or sewerage, while in others it can be spent only on improving housing conditions. However, most of the directions are the same.

- The terms after which the family can dispose of the allocated funds also vary. For the federal materkapital, the period is set at three years, for the regional one it depends on the characteristics of the subject. Basically also three years, but there are exceptions.

- The conditions for obtaining are also different. A regional subsidy can only be issued to families with a certain level of income or living in its territory for a set amount of time.

Important! Regional family capital, like state capital, is issued to a family only once.

Maternity capital in the regions

Subjects Russian Federation also support large families. Within the framework of their powers, the legislature adopts local laws of a social orientation. Regarding regional capital or maternity capital, it can be noted that it is issued almost everywhere. The program does not work, however, other family support measures are applied there.

All benefits assigned by the region have a single basis - the birth of a child in the family. However, the conditions for granting, the amount and procedure for spending will differ. The table selectively provides information on the regional capital assigned in individual subjects of the country.

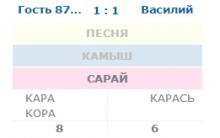

Table 1. Information on regional maternity capital in individual regions

| Subject | The period of birth (adoption) of the third child | Benefit amount in 2017 | Terms of Service | When can I use |

| Republic of Kalmykia | From 01/01/2012 to 12/31/2018; | RUB 62,348.88 | Special conditions apply only to families in which children appeared in 2017: the average per capita income is not more than 1.5 of the subsistence minimum | 3 years later |

| Belgorod region | after 01.01.2012 | 55388 rub. | A woman must officially reside in the region for at least three years | 3 years later |

| Kaliningrad region | after 01.01.2011 | The third or fourth child - 100,000 rubles, the fifth and subsequent - 200,000 rubles. at the birth of triplets -1,000,000 rubles. | The average per capita family income is not more than 3.5 times the subsistence level | After 1 year |

| Leningrad region | The period has not been set. Adopted must not be older than three months | 117360 rub. | Citizenship of the Russian Federation | After 1.5 years |

| Pskov region | Period not set | 100000 rub. | The average per capita income is not more than the subsistence level | 3 years later |

| Rostov region | after 01.01.2012 | 117754 rub. | The average per capita family income is not more than the subsistence level | 3 years later |

You can get acquainted with information about regional maternity capital in relation to all subjects of Russia.

Important! Many regions provide financial support to families only at the birth of a third child. In addition, this assistance is conditional, that is, in order to receive funds, certain criteria must be met: family income, registration in the region.

What can regional capital be used for?

Directions for the use of regional subsidies in most subjects coincide. The most popular are the following ways spending regional benefits:

- Improving the family's living conditions, including the purchase, construction, renovation, payment of the first or subsequent installments, . In the Belgorod region, according to the Social Code, funds can only be spent on housing.

- Acquisition of land for or giving. This method is not available in all regions, but it is possible, for example, in Kalmykia.

- Education of the child, while he can receive education at any level, starting with a music school, ending with a higher educational institution.

- Treatment or rehabilitation of a disabled child, in addition, the funds received can be used to purchase special means movement or devices.

- Buying a car or household appliances having a long service life. This direction is not available in all regions, for example, in the Leningrad region, a family can purchase the specified equipment if one of the children is disabled or the number of children is more than five.

- Some regions allow spending the allowance on engineering communications. This includes: gasification, electrification, water supply, sanitation, construction of wells and boreholes. Such conditions are seen in the Rostov region, the Republic of Kalmykia.

Note! Improvement of housing conditions, treatment and education of children is available in almost all subjects. To get more accurate information, you need to refer to the law of the subject.

Related video:

Table 2. What can be spent on regional maternity capital (full list of regions).

| Subject | Size, rub | How to spend | When to use | Conditions and Features |

| Altai region | 55387,5 |

| after 3 years | |

| Amurskaya Oblast | 100000* | improvement of living conditions | no limits | valid until 31.12.2016 |

| Arhangelsk region | 50000 | personal needs | can be used after 2 months from birth or 1 year from adoption | Russian citizenship; residence in the region for at least 3 years; obtaining the status of a large family |

| Astrakhan region | 58764 | ways are not limited | after 2 years | families with many children, subject to a registered marriage or single mothers living in the region for more than 3 years; income below the living wage |

| Belgorod region | 55388 | improvement of living conditions | 3 years later | permanent residence in the region for at least 3 years |

| Bryansk region | 100000 |

| 3 years later | you can use the money to pay interest and installments on the loan earlier |

| Vladimir region | 50000 | not limited | after 1.5 years | permanent residence in the area |

| Volgograd region | 70000 | determined by the centers of social protection | 3 years later | valid from 01.01.2016 |

| Vologodskaya Oblast | 100000 | not installed | after 1.5 years | at the birth of twins, an allowance is given for each |

| Voronezh region | 100000 |

| after 2 years | residence in the area for at least 1 year |

| Jewish Autonomous Region | 120000 |

| 3 years later | accommodation in the area |

| Zabaykalsky Krai | 50000 | for the needs of the family | not installed |

|

| Ivanovo region | 50000 | any purpose | from birth to 3 years | residence in the area for at least 3 years |

| Irkutsk region | 100000 |

| 3 years later | valid until 31.12.2018 |

| Kabardino-Balkaria | 250000 | improvement of living conditions | within a year after receiving the certificate | the subsidy is given only for 5 children |

| Kaliningrad region | 3 and 4 - 100000 Triplets - 1000000 |

| after 1 year |

|

| Kaluga region | 50000 | not installed | during a year | accommodation in the region |

| Kamchatka Krai | 1st - 100000 |

| no limit set | the program is valid until 2015, the subsidy is also due to the birth of the first child by a woman aged 19 to 24 years |

| Karachay-Cherkessia | 100000 | not limited | 3 years later | the subsidy is due for the 4th child |

| Kemerovo region | 130000 | improvement of living conditions | not installed | accommodation in the area |

| Kirov region | 3rd - 75000 | not installed | for children born before 12/31/2016, payments are provided in the period from 6 months to 1 year; for children born after the specified date, payments are made after 1 year until the child reaches 2 years of age | stay in the region for at least 1 year |

| Kostroma region | in the amount of the down payment, but not more than 200,000 | improvement of living conditions | not installed |

|

| 100000 |

| 3 years later | accommodation in the region | |

| Krasnoyarsk region | 100000 |

| 3 years later | accommodation in the region |

| Kurgan region | in the amount of the cost of 18 sq.m. housing | improvement of living conditions | undefined |

|

| Kursk region | 75000 For triplets - 100,000 |

| 3 years later | accommodation in the area |

| Leningrad region | 117360 |

| after 1.5 years |

|

| Lipetsk region | 50000 For twins - 100,000 For triplets 120000 | not installed | not installed |

|

| Magadan Region | 100000 |

| not installed | the allowance is also given for the first child born to women under 25 years of age |

| 100000 |

| 3 years later | the birth of a second child | |

| Murmansk region | 100000 |

| not installed | accommodation in the region |

| Nenets Autonomous District | 300000 |

| in a year | residency in the area for at least 1 year |

| For the 2nd - 25,000 For the 3rd - 100000 |

| since birth for the 3rd; After 1.5 years for the 2nd child | accommodation in the area | |

| Novgorod region | 100000 200,000 - if the family improves housing conditions |

| not installed | residence in the area for at least 2 years |

| Omsk region | 100000 |

| 3 years later | |

| Orenburg region | 116 866 |

| 3 years later | the birth of 3 children and living in the region |

| Perm region | 100000 |

| after 2 years | the birth of 3 children and residence in the region from 5 years |

| Primorsky Krai | 150000 |

| in a year | the birth of 3 children and residence in the region, citizenship |

| Pskov region | 100000 |

| 3 years later | family income is less than the living wage |

| Republic of Adygea | 50000 | not installed | not installed | the birth of 3 children and residence in the Republic |

| Altai Republic | 50000 |

| 3 years later | birth of 4 children and residence in the Republic for at least 1 year |

| Republic of Bashkortostan | 100000 |

| not installed | subsidy paid for the adoption of a child |

| The Republic of Buryatia | 50000 |

| not installed |

|

| The Republic of Dagestan | for 5 - 10000 For 10 - 300000 For twins - 20000 For triplets 100000 | not installed | within a year after birth | residence in the Republic |

| Republic of Kalmykia | RUB 62,348.88 |

| 3 years later | special conditions apply only to families in which children appeared in 2017: the average per capita income is not more than 1.5 of the subsistence minimum |

| Republic of Karelia | 105500 |

| in a year | Residence in the Republic, the birth of 3 children |

| Komi Republic | 150000 |

| six months later | Permanent residence in the Republic, birth of 3 children |

| Mari El Republic | 50000 | not installed | not installed |

|

| The Republic of Mordovia | For the 3rd - 125270 For the 4th - 150324 For the 5th 187906 |

| 3 years later |

|

| The Republic of Sakha (Yakutia) | 100000 |

| not installed |

|

| Republic of North Ossetia-Alania | 50000 | for the needs of the family | 3 years later |

|

| Tyva Republic | 50000 |

| 3 years later |

|

| The Republic of Khakassia | 100000 For small villages - 200,000 |

| its installed |

|

| Rostov region | 117754 |

| 3 years later | family income below the living wage |

| Ryazan Oblast | 61173,57 |

| after 1 year |

|

| Samara Region | 100000 |

| after 1 year |

|

| 100000 |

| 3 years later |

|

|

| Saratov region | 100000 |

| 3 years later |

|

| Sakhalin region | 204263 |

| 3 years later |

|

| 150000 |

| after 2 years Regardless of the term, if the money is required to repay a loan or rehabilitate a disabled child |

|

|

| Smolensk region | 163 300 |

| 3 years later |

|

| Stavropol region | ||||

| Tambov Region | 100000 | purchase of a house, gasification, repair | not installed |

|

| Tver region | 50000 | improvement of living conditions; engineering communications; purchase of furniture and household appliances; purchase of a car and agricultural machinery or animals | in a year |

|

| Tomsk region | 100000 |

| 3 years later |

|

| Tula region | 50000 |

| not installed |

|

| Tyumen region | 40000 | for the needs of the family | not installed |

|

| Udmurt republic | 300000 | to pay off debt under a loan agreement | not installed |

|

| Ulyanovsk region | On the 2nd - 50000 On the 3rd - 100000 On the 4th - 150000 On the 5th 200000 On the 6th - 250 00 On the 7th 700000 |

| after 1.5 years | accommodation in the area |

| Khabarovsk region | 200000 |

| after 2 years |

|

| Khanty-Mansi Autonomous Okrug-Yugra | 100000 |

| after 1 year |

|

| Chelyabinsk region | 50000 |

| Not installed |

|

| Chuvash Republic | 100000 |

| 3 years later |

|

| Chukotka | 100000 | for the needs of the family | after 2 years |

|

| Yamalo-Nenets Autonomous Okrug | 350000 |

| after 1 year |

|

| Yaroslavl region | 56606 | for the needs of the family | not installed |

|

*The amount of capital is indexed. Please refer to your local laws for the exact amount.

Accepted abbreviations: PP - Government Decree, PA - Administration Decree.

Author: . Higher legal education: North-Western branch of the Russian Academy of Justice (St. Petersburg) Work experience since 2010. Contract law, consulting on taxation and accounting, representation of interests in state bodies, banks, notaries.

June 24, 2017 .

In 2018, the maternity family capital (MSK) program proposed by Vladimir Putin celebrates its 11th anniversary (it began operating on January 1, 2007). During this time, state certificates for mother capital have already been received 7.8 million families in which a second or subsequent child was born or adopted during the given period.

When the certificate is received, parents have a question: how and where to use family capital to make it the most profitable and useful? The specifics of the provision of payments under this program is that:

Where can maternity capital be directed according to the law?

There are no significant changes in the list of areas for using family capital in 2018. As before, capital can be spent:

One-time payments from maternity capital

Will there be payments from maternity capital in 2018- at the moment it is difficult to say. In previous years, such payments were provided no more than two times in a row:

Measures for social adaptation at the expense of mat. capital can be held as for native children, and for adopted at any time from the date of birth (adoption) of the child who gave.

Maternity capital for mom's pension

In order to manage the funds of maternity capital in favor, a woman just needs to file a Pension Fund the corresponding statement. collect some additional documents, unlike all other directions provided by law, will not be required.

Legislation approved 3 options receiving these funds:

- As funded pension, which is paid for life and monthly. The amount of the monthly payment is determined taking into account the expected period of payment of the pension. When calculating the payment, in addition to the MSC funds, all the savings of the certificate holder accounted for in the Pension Fund on her individual personal account are taken into account;

- As urgent pension payment. The duration of this payment is determined by the woman, but its minimum period is 10 years. It is established and paid, including at the expense of the mother's capital, aimed at the formation of a pension, and from their investment income;

- As lump sum payment if the funded pension is 5% or less in relation to the sum of the amount of the insurance old-age pension, taking into account the fixed payment, and the amount of the funded pension, calculated on the day the funded pension is established. This payment is also assigned to persons receiving an insurance pension for disability, for the loss of a breadwinner or for state pension provision, who, upon reaching retirement age, did not receive the right to an insurance old-age pension due to the fact that they do not have the necessary length of service or the amount of pension points is not less than 30.

Women who initially chose this option for managing family capital funds can later change their choice to manage MSC funds in any other direction.

What is it forbidden to use maternity capital for?

Everything possible options spending funds from mother capital are enshrined in Federal Law No. 256-FZ of December 29, 2006. “ On additional measures of state support for families with children". Any other areas, in addition to those listed, by law not provided. But many of them cause a lot of discussion around them and are the subjects of speculation in society.

There are situations when a family does not find the possibility of using MSC for any of the options allowed by the family capital program. Perhaps for this reason, attackers are developing illegal schemes.

Buying a car with maternity capital

At the federal level, proposals have been made many times about the possibility of spending family capital with the need to register it as a common shared property of parents and all children.

This included such restrictions:

- resale of the car was prohibited for a certain time;

- the car had to be produced in Russia;

- the purchased car should not have previously been registered with the traffic police.

But all legislative initiatives on the possibility of buying a car using the funds of a parent certificate were rejected by the Government of the Russian Federation.

Acquisition of land for construction or summer cottages

The intended use of family capital for the purchase of real estate provides that it is intended for living, that is, the characteristics of the object must comply with the standards for housing. It is theoretically possible to buy a cottage for maternity capital if the building has the following features:

- the object is assigned a postal address;

- the building is designed as a dwelling;

- in accordance with technical specifications there is the possibility of year-round living;

- registration of citizens is possible at this address.

It is necessary to take into account the fact that when choosing such an object, the Pension Fund does not approve the purchase dilapidated, emergency or temporary structure.

Maternity capital for the repair of an apartment or house

In the law of December 29, 2006 No. 256-FZ, there is no such wording as “repair” - therefore, send a certificate for apartment renovation will not work. Another thing is when the conversation is about an individual residential building. In August 2010, amendments to the law introduced the concept, which means changing the design of a house in order to increase in living space.

A good example is the construction of another floor in the house or the addition of another room to the house. The increase in living space should not be less than the norms of living space established by the law of a particular region per person. Redevelopment of the apartment, and even more so its decoration reconstruction is not, therefore, you cannot spend MSK in this direction.

According to part 3 of article 7 federal law dated December 29, 2006 N 256-FZ "On additional measures of state support for families with children" can be spent on the following purposes:

- Improvement of living conditions:

- acquisition or construction of residential premises carried out by citizens through any transactions that do not contradict the law and participation in obligations (including participation in housing, housing construction and housing savings cooperatives or to an individual, carrying out the alienation of the acquired residential premises, or an organization, including a credit one, that provided under a loan agreement (loan agreement) cash for the specified purposes;

- construction or reconstruction of an object of individual housing construction, carried out by citizens without the involvement of an organization that performs the construction (reconstruction) of an object of individual housing construction, including under a construction contract (hereinafter - Building company), as well as to compensate for the costs incurred for the construction or reconstruction in this way of an object of individual housing construction, by transferring these funds to the bank account of the person who received the certificate.

- Getting an education by a child (children) :

- payment for paid educational services that are provided by educational organizations with state accreditation educational programs;

- payment of other expenses related to education:

- payment for the use of residential premises and utilities in a hostel provided by an educational organization to students for the period of study;

- Social adaptation and integration into society of children with disabilities;

- Receiving a monthly payment in accordance with Federal Law N 418-FZ of December 28, 2017 “On monthly payments to families with children”.

It should be noted that the funds of mother capital are not handed out. It is not necessary to spend maternity capital in only one direction in full, you can spend money in parts, for various needs. The most common use of maternity capital today is to improve housing conditions.

The disposal of maternity capital by a person to whom a certificate has been issued is carried out for the purposes and in the amount indicated by him in the application for the disposal of funds (part of the funds) of maternity (family) capital.

In case of crisis manifestations in the economy, in order to ensure its sustainable development and social stability, the country's leadership decides on an additional measure social support families with children:

- Providing a lump sum payment at the expense of maternity capital.

This decision was made in 2009 and 2015. The last payment was made in accordance with the Federal Law "On a one-time payment at the expense of maternity (family) capital in 2016", signed by the President of Russia V.V. Putin. N 181-FZ on June 23, 2016 and granting the right to a one-time payment at the expense of maternity (family) capital in the amount of 25,000 rubles if such a right arose before September 30, 2016 inclusive, provided that the child (children) reaches the age of majority or the acquisition by him (them) of legal capacity in full before reaching the age of majority.

Yes. The federal law "On additional measures of state support for families with children" does not provide for restrictions related to the ownership of mortgage security for a loan that is planned to be repaid with maternity capital ...

No. Part 2 of Article 3 of the Federal Law of December 29, 2006 N 256-FZ "On additional measures of state support for families with children" establishes that when the right to maternity capital arises, adopted children who at the time of adoption were stepchildren or stepdaughters are not taken into account. ..

The influence of the middle name on the name Yuri

Name Ilya - meaning and contraindications

Baby keeps crying

What does the name Aidar mean, the mystery of the name

Name Ilya - meaning and contraindications