To date, quite a lot of people have come across bank loans. When applying for a loan at a bank, many are reinsured and take a repayment period large enough. In reality, it often turns out to pay off the entire loan much faster, but at the same time it becomes clear that during the time of payments the bank received too much from the borrower. Is it possible to return interest on a loan in case of early repayment? This issue should be considered in detail.

Possibility to return interest

Often, financial institutions immediately prescribe additional commissions in regular payments that are not related to the payment of the debt itself or accruals on it, so it becomes problematic to return these funds. The return of interest paid upon early repayment of the loan is real only if the relevant application is properly executed and confirmation that the loan has been repaid in full.

Given these factors, you should pay attention to other terms of the loan agreement. So, in a written contract, it may generally be indicated that it is impossible to repay the loan ahead of schedule within a certain period of time.

- each financial institution has its own specific conditions for early repayment;

- even in the event of early repayment, the borrower is required to pay monthly installments until full payment is confirmed.

What can you get your money back for?

Return of overpaid interest in case of early repayment of the loan is not the only volume Money, which the client of the bank has the right to receive from the organization in case of premature closing of the debt.

Among them:

- commissions for servicing and opening an account (if the borrower did not sign the agreement);

- commission for processing a loan (if the borrower did not sign the agreement);

- insurance payments, if the contract for them has not been issued;

- actually overpaid interest on the loan;

- other hidden additional fees.

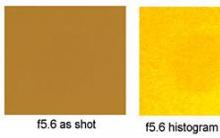

The most common type of monthly payments

According to this type of settlement with a financial institution, an individual or entity undertakes to pay regularly a strictly fixed amount. It includes both payments on the repayment of the debt itself, and payments on interest and other fees. Such payments are called annuity, the return of interest upon early repayment of the loan in this case is the most relevant.

The thing is that such payments at the very beginning of the period contain most of the interest, and not the debt itself. It turns out that with mortgage lending for decades, the first couple of years the borrower pays almost one percent, leaving the debt itself outstanding.

It is also important to know that a special formula must be applied to correctly calculate the interest on an annuity payment, but many banks simply divide the annual interest by 12 and give the result for monthly obligations, which actually exceed the real figures by several points.

The myth of the annuity

Many are of the opinion that the return of interest on a loan upon early repayment will be as significant as possible when paying the loan in fixed payments. The fact is that in such payments an amount is paid for the repayment of all accruals, which is also supported by the courts. Actually it is not. When considering in detail the calculation of the annuity payment for each payment period, it becomes clear that the calculation of interest is carried out separately for each last month of using the money. That is, there is no overpayment of accruals in advance in this form of payment.

Early redemption rules

From the point of view of monetary settlements, the return of interest on a loan upon early repayment is a complex and painstaking task, but given the possible size of the amounts received back, the process is worth it. To maximize the likelihood of approval of the application for a refund, you should strictly follow all the conditions for early redemption. Initially, it is necessary to warn the credit institution in advance about the desire to pay off your debt ahead of schedule. It is best to do this in writing or online if the bank has the option. After that follows:

- deposit the required amount to the account of the organization, while receiving a receipt;

- receive written confirmation of the full repayment of the debt and the absence of obligations to the bank.

The latter can be done only one month after the entire amount has been deposited directly at the financial institution.

Given the terms of the contract, after all of the above actions, you can file a claim for the return of overpaid funds. First, to a credit institution, and then, in case of refusal, to the court.

Legal Issues

The return of interest, judicial practice, as a rule, considers on the basis of various information letters from higher judicial instances. According to their conclusion, interest on loans is considered fees for the use of funds, which means that they must be paid to a credit institution only for the period in which the money was at the disposal of the bank client. Thus, the requirement to pay accruals for the period when the loan has already been repaid, including prematurely, is illegal.

It is also important to know that even if the text of the agreement between the bank and the client contains a prohibition on the return of interest, the credit institution will still be obliged to return the funds upon a relevant application under the law. In addition, the financial institution is obliged, under any conditions, to recalculate the funds contributed in case of early repayment of the debt.

Given these legal nuances, working on the side of the borrower, you can safely practice litigation with credit organizations on the return of overpaid funds to them.

How to determine the amount of the overpayment?

Return of interest on a loan in case of early repayment can be calculated in two ways. More painstaking is the calculation through determining the difference between two annuity flows. Thus, the borrower must determine the difference between the current annuity conditions for the current term of the loan and those conditions that could be presented to him when applying for a loan immediately for a shorter period in which early payment is made. This type of calculation is rarely taken into account by lawyers and may be relevant only subject to regional judicial practice under these conditions.

Most often, calculations are made in a simplified way, which is also taken into account by lawyers. It includes a proportional recalculation of accruals for the term of the contract. To do this, calculate the amount of all interest accrued over the term of the agreement.

Thereafter:

- calculate the loan repayment period and accruals already paid;

- Divide the amount of all interest by the term of the loan and multiply by the number of payments already paid.

The result of the calculations will be the amount that should have been paid for the period of use bank funds. The difference between the real number and the one obtained during the calculations is an overpayment that can be demanded from a credit institution. In order not to make mistakes in independent calculations, you can use a loan calculator, which is freely available.

The nuances of the return

Self-calculations are not always accurate, since bank employees may additionally include additional payments unaccounted for by the borrower. So, the return of interest for can be carried out according to other calculations, in which independently calculated amounts will be only approximate.

It is important to understand that it is impossible to return interest for the period when the money was in use by the borrower, because this amount is a payment to the bank and is protected by law on the side of credit organizations.

Taking into account all of the above, one should not rush into calculations, but determine whether there is at all the possibility of premature repayment of the debt in the contract.

Sequencing

Early repayment of a loan at Sberbank, the return of interest on which can also be carried out under the law, must take place in accordance with all the terms of the agreement. Otherwise, the bank may turn the situation in its favor, therefore, before starting any proceedings, it is better to consult with a qualified specialist and familiarize yourself with the results of already carried out court proceedings of other persons.

After that, it is necessary to prepare a written application to the court. According to the law, if the amount of the claim exceeds 100 thousand rubles, then the application should be considered already in the district offices. You should also warn the credit organization in advance about the intention to file a lawsuit in court. In some cases, banks agree with the borrower's claims, and all issues are resolved without involving the courts.

Application rules

Early repayment of a loan at Sberbank, more precisely, the return of interest is carried out when drawing up an application in a form fixed in the organization. In some cases, unscrupulous employees may simply refuse to issue the required form to the client, and then the application can be written in free form. If the acceptance of such an application is also denied, you must contact the management and ask for a copy of the application they accepted with a mark of its acceptance and date.

In order to return interest upon early repayment of the loan, the application must contain:

- passport details of the applicant;

- all data on the concluded loan agreement;

- account number to which the overpayment will be transferred.

A copy of the loan agreement must also be attached to the application. The application is usually considered for at least three days.

Refund of additional payments

In addition to overpaid interest, borrowers often find among the services they pay for those that they do not use at all and did not subscribe to their accrual at all.

These include:

- mobile bank;

- insurance premiums and so on.

The services imposed by the bank can be canceled at any time upon the application of the borrower, and if their payment was included in the monthly installments, the bank is obliged to recalculate and, if necessary, return the funds to the client.

It is important to know that even with unconscious use of services, you will have to pay for some time. Also, certain types of commissions are not subject to cancellation - a fee for issuing a loan and servicing an account, since the conditions are standard for all types of agreements.

Conclusion

Be sure to read the terms and conditions of the bank before applying for financial assistance. Early repayment of the loan, return of interest, annuity payments, return of additional payments - all this is enough complex concepts which should be carefully considered. Of course, given the likely size of the amounts received, the process is fully justified.

When applying for any loan at a bank, the borrower realistically assesses his capabilities and expects that he will be able to repay the money taken in a year, two or five years. But new sources of income may appear, a person can be transferred to a more paid position, he can sell real estate, receive an inheritance. And when free money appears for early repayment, the borrower may quite reasonably want and demand the return of part of the interest in the bank - no one wants to overpay too much. Moreover, if everything is done correctly, then part of the money can really be returned.

Application for refund of overpaid interest on a loan

Loan interest is calculated in two ways - annuity and differentiated. The latter implies the accrual of interest only on the balance of the debt. This means that with a differentiated accrual method, the amount of the monthly payment decreases by the end of the payment period. And if the borrower repays the loan ahead of schedule in the bank, then the rate is applied only for the period of actual use of the borrowed money.

A completely different case is with a loan, which implies an annuity repayment method. In this case, the monthly payment will be the same, that is, it will be charged in equal amounts. And in his calculation there is a part of the payment of the body of the loan and part of the interest payment, originally calculated on the entire amount of the debt. Moreover, if you take a printout of the payment of payments, it will be seen that in the first months the consumer pays the bank mainly interest for the use of borrowed funds, and by the end of the term, the body of the loan makes up most of the monthly payment.

Therefore, if a consumer or mortgage loan was issued in an annuity way (and in most cases the bank charges this way), then, on its own initiative, the financial institution will not return the overpayment. And to get the money, you have to write to the bank an application for recalculation.

For consumer credit

A consumer loan in a bank can be issued for six months, and for 5 years. Accordingly, during this period, the borrower can quickly pay the entire loan amount. But you can return the overpaid money only if you make an application to the bank for the return of interest on a consumer loan, a sample of which can be viewed on the website.

In addition, the borrower has the right to return the insurance, if it was provided for by the contract. If less than a month has passed since the insurance was issued, then you can return the full payment. If the insurance is issued up to six months ago, then you can return 50% of the amount of contributions.

On a loan from Sberbank

The legislation of the Russian Federation provides for the procedure for filing at any bank an application for the return of interest on a loan at Sberbank sample. Such an application to Sberbank for recalculation is submitted one month before the date of the desired repayment of the loan. The text of the application for the return of overpaid money shall indicate:

- personal data of the borrower;

- number of the loan agreement;

- amount due;

- date of transfer of funds to the bank;

- repayment method - payment in cash or from a bank account.

If the loan will be repaid in full, it is advisable to first obtain an extract from the bank on the exact amount of the debt. Otherwise, pennies of debt may remain on the account, for which money can be recalculated and even a fine charged. In a short time, the debt will grow, and the bank will put another financial obligation in front of its client - the borrower will again have to pay the money.

How to write an application for a refund of interest on a loan?

In case of early repayment of a loan from a bank, the borrower quite reasonably wants to return part of the money paid. For this, a sample application for the return of interest on a loan upon early repayment is useful. After all, if such a condition is not spelled out in the contract, then the bank will not give the funds of its own free will.

We figure out how to write an application for reimbursement of interest, tax or insurance on a mortgage loan at a bank. The form of the document provides an indication:

- personal data of the borrower;

- reasons why he wants to pay off the debt ahead of schedule;

- a request to recalculate for the time when the borrower does not use the bank's funds;

- economic calculation - how much money was actually paid, how much should have been received for the actual loan period, as well as the amount of the overpayment.

Statement of claim for the return of interest on a personal income tax loan when buying an apartment

Often there are situations when banks refuse to recalculate borrowers. But if the bank did not respond to the application for the return of the interest paid on the mortgage loan, then the court will take it into account. Such a tool works if you correctly draw up a statement of claim and fill out the form. There are cases of judicial practice of the Supreme Court of the Russian Federation, when it is recognized that a bank must take its income for the period when a person uses borrowed funds. And the borrower does not have to pay money for the time when he does not use the loan, that is, in case of early repayment.

The main thing in this situation is not just to go to court, but to make the right calculation in order to show the money overpaid to the bank. This can be done with the help of a competent economist. Or on your own using an online calculator. Only it should not only show the monthly payment amount, but also give a breakdown:

- what part of the monthly payment is the body of the loan;

- and how much is the interest paid to the bank.

Moreover, the absurdity of paying this money for the time when the borrower does not use the bank's funds is not the only argument. The application can show that in case of early repayment, the amount of interest paid significantly increases the loan rate. And this is especially evident when buying an apartment - after all, a mortgage is issued for 20 years.

A bank loan is a service, the demand for which is growing every year. But the main problem remains unchanged - it is associated with low financial literacy of people who apply to banking institutions for loans. People often do not understand how lending works and what to do in case of early payment of debt.

The annuity payment scheme is in the greatest demand for lending. Its peculiarity lies in the conditional division of the loan term into two parts. In the 1st, the "lion's" share of interest is paid, and in the 2nd - the main debt.

If the client copes with obligations ahead of time, he has the right to ask return of interest on a loan in case of early repayment. The dilemma is that many do not know how to protect their rights in the fight against a creditor, what to take into account when calculating the amount to be returned, as evidenced by the practice of litigation in the issue of return. Let's consider these points in detail.

What you need to know about the return of interest?

The lender must return the funds in case of early repayment of the loan, overpaid by the client in the previous period. A number of banks are silent about such obligations, and find reasons not to transfer the due amount to the borrower.

If the bank does not return interest upon early repayment of the loan, the client has the right to act - to apply to the judicial authority or Rospotrebnadzor. To protect interests, there must be an agreement, a receipt for the payment of debt, a certificate of early termination of cooperation and a statement (copy) on the refusal of the creditor to return the money.

Credit institutions work in the legal field and adhere to the laws. If the borrower has repaid the principal and interest and reasonably demands compensation for early repayment, the bank will meet halfway and will not risk reputation. As an example, in Sberbank, payments are made easily and naturally.

Algorithm of actions of the borrower

Before returning interest on a loan upon early repayment, it is worth understanding the issue and following the following algorithm:

- Find out the amount of debt at a certain point.

- Submit an application. It requires you to specify the amount and date of payment. In case of full early repayment, the bank has the right to ask about the transfer option and card number.

- On the specified day, pay the required amount. Here you should be careful and pay off the debt down to the last penny. In case of early repayment, the money is paid for the entire period. Otherwise, the loan is not closed, and the borrower is forced to go through the procedure again.

- Take a certificate confirming the payment of the debt. This paper will be required when clarifying the amount of debt from the bank.

How to return interest on an annuity?

When applying for a loan, the agreement between the parties indicates the type of debt repayment - annuity or differentiated. In the first situation, the size of the annuity is identical for all months, and in the 2nd, the payments are decreasing.

With annuity payments in case of early repayment, it is worth requesting a refund of the overpaid money. In the case of differentiated payments, there is no overpayment, so there is no need for a refund.

How is the overpayment formed?

It is easy to figure out how to return overpaid interest in case of early repayment of a loan. To do this, it is worth understanding the principles of calculation for an annuity. The algorithm of actions is as follows:

- The debt is charged at the rate stipulated in the agreement between the parties.

- Interest is added to the amount of debt.

- The received amount of funds is divided by the number of months (indicated in the contract).

- The borrower pays the same amount every month.

- A one-time payment consists of two elements - debt and interest. In order to equalize the amount of payments, the first months the borrower repays the minimum amount of debt, and most of it is occupied by interest payments.

If the borrower repays the money ahead of time, the amount of the overpayment is determined and part of the money already paid earlier is returned. The calculation of overpaid interest is carried out in two ways - using a special program or manually.

Subtleties of self-calculation

Consider how to recalculate interest on early repayment of a loan. The following formula applies here:

P = Ploan/Sloan * Sfact, where,

Sloan - the period for which the agreement between the parties is executed (calculated in months). Ploan - the amount of overpayment for the period Sloan

Sfact - the actual period of repayment of the loan (indicated in months).

P - the amount of interest calculated for the actual application of the loan.

The amount of excess overpayment is calculated by means of the following operation: Pfact. - P, where Pact is the actual amount of interest payments for the period Sact.

To understand the calculation, consider the situation of early payment using an example.

The client draws up a loan in the amount of 10,000 rubles for a year (12 months). Interest rate- 16%, and the payment is made in five months.

Loan = 888 rubles.

Sloan = year.

Sfact. = five months.

Pfact. = 562 p.

P = 370 rubles

The calculation is carried out as follows: 888/12*5.

The amount of the overpayment is 562 "minus" 370 "equal" 192 rubles.

Algorithm of actions for the return of overpaid interest

Reimbursement (return) of overpaid interest in case of early repayment of the loan is carried out according to a certain algorithm. It is worth applying for overpaid money after issuing a certificate confirming the end of credit obligations. The process looks like this:

- Early repayment of the debt, taking into account the amount prescribed in the agreement.

- Obtaining a certificate from the bank confirming the absence of debt (the paper is issued free of charge).

- Calculation of overpaid funds using the above formula or an online calculator.

- Preparation and submission of an application for the return of excess interest charges.

- Receipt of overpayment or refusal of a banking institution.

How to apply?

The preparation of an application for repayment of a loan in case of early repayment deserves special attention, because the success of further proceedings depends on its content. The form is issued by a credit institution. If the bank refuses to issue, the paper is issued in a free form. It must contain the following information:

- Personal information from the client's passport and the name of the financial institution.

- Agreement number and date of registration.

- Data from the contract (rate, validity period, amount).

- Date and amount of money transferred as early repayment.

- Loan disbursement information.

- The amount of overpaid interest.

- An order to pay a certain amount.

- Details of the account (card) where you want to transfer money.

- Informing about the intention to apply to the court in case of refusal.

- Signature and date of issuance.

Do I need a certificate confirming the repayment of the debt?

The bank is obliged to recalculate interest on early repayment of the loan. The basis for such manipulation is an application indicating the above information and a certificate confirming the repayment of the debt. The financial institution is aware of the right to return the "extra" amount, therefore, it must meet the needs of the client.

Prohibition of overpayment in the loan agreement - is it real?

Considering the dilemma of whether it is possible to return interest upon early repayment, it is worth studying the terms of the contract. Some financial institutions are cunning and indicate that interest accrued upon early payment is not returned. If the client of the creditor is an individual, he has the right to apply to the judicial authority and demand recognition of the invalidity of the agreement. He will be right, because his actions are based on the Law that protects the rights of consumers, as well as the Civil Code of the Russian Federation. Even if the money is taken for an individual entrepreneur, such a clause of the contract can also be canceled.

If, when making an agreement, the borrower sees a similar clause, he has the right to complain to Rospotrebnadzor. To do this, you need to attach a copy of the agreement, and in the application indicate a request to hold the creditor liable under the Code of Administrative Offenses of the Russian Federation, article 14.8.

What does the jurisprudence say?

As soon as the procedures are completed and the application is transferred to the bank employees, the borrower awaits a decision. If the creditor refuses to pay the money, further actions go through the court. Analyzing the judicial practice of resolving disputes in case of payment ahead of time, it is worth noting that there is no clear law that would regulate the issue under consideration. Thus, the Civil Code of the Russian Federation (Article 809) states that no interest is charged for the unused loan term. The financial institution employs lawyers who do everything necessary to protect the interests of the employer.

The courts are clear on this issue. Interest is accrued for the period when the client used the banking service. The Supreme Court has dealt with similar cases before, and banks lose more often. That is why borrowers should not be afraid to defend their interests through the judiciary. Lawyers highly appreciate the chances of winning when filing lawsuits against banks (if they refuse to return interest on early repayment).

The desire to get even with debts and repay the loan as soon as possible is understandable, probably, to everyone. Borrowers who monthly make payments exceeding the planned ones, or close the loan ahead of schedule, pursue the same goals - to reduce their overpayment on the loan and get rid of the status of "debtor". How simple is the procedure for early repayment of the debt and does it allow you to significantly reduce the cost of the loan? About this, as well as about the technical side of the process of early repayment of the loan, we will tell in more detail.

Full and partial early repayment of the loan

You can repay the loan ahead of schedule in full or in part. In the first case, you deposit into the account an amount equal to the balance on the "body" of the loan, and the interest accrued at the time of repayment. After that, your debt to the bank is closed. In the second case, you deposit an amount that exceeds your monthly payment indicated in the schedule. The loan is not closed, but bank employees are obliged to give you a modified repayment schedule: according to the agreement, either the planned payment or the loan term will be reduced in it (in both cases, the amount of accrued interest will be reduced).

Banks have always sought to complicate the procedure for early repayment of a loan as much as possible and make it unprofitable for the client. This desire was explained simply: the financiers did not want to lose their profit in the form of interest. Now the situation has changed somewhat, but problematic moments still remain. Next, we will look at the legal basis for early repayment of debt and find out what changes have been made to existing laws over the past 2 years.

Early repayment - the legal side of the issue

The procedure for early repayment of a loan is regulated by the Civil Code of the Russian Federation. October 19, 2011 was adopted the federal law No. 284-FZ "On Amendments to Articles 809 and 810 Part 2 of the Civil Code of the Russian Federation." This legal act officially banned the collection of fines and penalties from borrowers for early repayment. In particular, the law establishes:

- The right of the bank to receive interest from the borrower under the agreement, inclusive, until the day the debt is repaid in full or in part (Clause 4, Article 809 of the Civil Code of the Russian Federation). Previously, banks had the right to demand payment of interest for the entire period of the agreement (regardless of when the borrower actually closes the loan), as well as to charge fines and penalties for deviation from the schedule. Note that this law is retroactive, that is, even if your loan agreement stipulates the right of the bank to demand payment for early full or partial payment of the debt, according to Law No. 284-FZ, these norms are recognized as invalid.

- The obligation of the borrower to notify the creditor of the intention to repay the debt ahead of schedule at least 30 days before the planned repayment date, unless a different, shorter period is established by the agreement (Article 810 of the Civil Code of the Russian Federation). This only applies to personal loans. In fact, in order to comply with this requirement of the law, the borrower must personally contact the bank and draw up a notice, which they are required to accept and register.

- The possibility of early repayment of the debt with the consent of the creditor (paragraph 2 of article 810 of the Civil Code). Previously, this paragraph was not in the Civil Code. Now, banks, not being able to fine borrowers, have the right to deny them the possibility of early repayment. This is used by many financial institutions, especially when it comes to paying off mortgages and car loans. In some cases, banks indicate the minimum amount of early repayment of the loan. Formally, this is done in order to prevent clients from abusing their opportunities, in practice - to limit the client's right to reduce the overpayment on the loan.

Other changes in the legislative framework are expected in the near future: this fall, in the Second Reading, the State Duma will consider the law "On Consumer Lending", which provides for a ban or imposition of commissions on early repayment of mortgage loans during the first year of the loan agreement.

The scheme for early repayment of a loan may differ for each bank. Next, we will look at the main options and give recommendations to those borrowers who want to repay loans ahead of schedule and at the same time not have problems with their lenders.

Rules for applying for early repayment of a loan and basic recommendations for borrowers

Most banks have approved the following scheme for early repayment of the entire loan or part of it:

- at least 30 days before the scheduled date of repayment, the borrower visits the branch of the bank where the loan was issued and draws up a notice of his intention, indicating in it the expected amount of payment;

- usually you need to call the manager to get an answer. In most banks, "tacit consent" can be obtained immediately, but sometimes you need to wait up to 5 days;

- The financiers will tell you the deadline by which you need to make a payment. This is usually the date the required planned payment is made. You don't have to come to the bank on that particular day. You can deposit funds into the account in advance, but the schedule will be recalculated on the day set for making the planned payment (if the repayment is partial). With a full early return of funds, date restrictions are rarely applied, since the schedule does not need to be recalculated;

- in case of a partial refund, after the day set for making the planned payment, the client must contact the bank branch to receive a modified payment schedule;

- with a full refund, the client must contact the branch and receive a written notification that his loan agreement is closed (usually the bank issues a letter issued on letterhead signed and stamped by the head of the territorial division). It is necessary to receive a notification at least in order to be sure that the bank no longer has claims against you, that you do not have an outstanding debt, on which interest and penalties will then be accrued. Also, these letters may be required when applying for a loan at another bank and in case of disputes with the client's credit history. Lending organizations may “forget” to provide information to the BKI that you closed your loan in advance.

The scheme described above is the most common. There are also variations, for example:

- some banks can recalculate the schedule on any day, so you can repay the loan ahead of schedule at any time convenient for you;

- the amended schedule may be issued before the payment is made, but becomes effective after the partial early payment of the debt is made;

- in some credit institutions, the process of early repayment is simplified as much as possible. You can, without notifying the bank, on your own, for example, using Internet banking, deposit an amount in excess of your planned payment to your account, and then print the newly generated payment schedule. In this case, with full early repayment, it is still recommended to contact the branch and receive a letter on closing the loan.

Having considered the procedure for early repayment, we should return to the issue of its benefits. More about this.

Calculating the benefit of early repayment: when is it appropriate to “get ahead” of the schedule?

As you can see, by paying off the debt six months ahead of schedule, contrary to popular belief, you will save more with the annuity scheme.

Thus, we were convinced that early full and partial repayment of the debt is always beneficial, despite the fact that banks are trying in every possible way to complicate this procedure. By accumulating funds and not sparing time, you can significantly reduce the amount of overpayment on the loan. In addition, getting rid of the status of "debtor" always has a fruitful effect on a person: financial freedom is an important aspect that should not be forgotten.

Most Russian citizens have several existing loans. They are issued for housing, transport, consumer needs. At the same time, many pay their debts ahead of schedule. Is early repayment possible? This procedure is described in the article.

Early payment

Is early repayment possible? According to Federal Law No. 284 of October 19, 2011, changes appeared in the Civil Code of the Russian Federation. Every citizen has the right to early payment of the loan. At the same time, the bank cannot charge commissions and fines for this service. Therefore, the return of interest on a loan upon early repayment is considered a legal right. Even if this is not mentioned in the contract, you can contact the bank to receive your funds.

Not later than one month before the planned payment, you must write an application and submit it to the bank. You don't need an answer for this. It should be borne in mind that some banks limit the term for early payment of the loan. For example, for 3 months. Otherwise, fines are imposed. It also happens that if the loan is granted for a short period, then early repayment is impossible.

Full and partial early repayment of a loan at Sberbank and other financial institutions has its advantages. Client pays less percent for the use of the funds, so he will pay off the debt earlier. Will the insurance be returned in case of early repayment of the loan? The return of this amount is the right of the borrower. To do this, you need to write a statement, and it is better to do this on the closing date of the contract.

Is it possible to return?

Is it required by law to return interest on a loan in case of early repayment? In Art. 809 of the Civil Code of the Russian Federation states that interest is considered a fee for using a loan, they should be transferred only for the period of using the service. Therefore, everything that was credited to the bank in excess of the required amount must be returned to the client.

Since many banks use annuity (equal) payments in their work, banks receive increased profits with early payment. The fee is charged for the time that is not used by the borrower. That is why it is possible to return interest on a loan in case of early repayment.

Can the bank prohibit the return of interest in the contract?

When concluding a loan agreement, the borrower should pay attention to important nuance. Some banks include a clause in the agreement stating that accrued interest cannot be recalculated and returned.

If the consumer is individual, then this clause may be declared invalid on the basis of a court decision. This is done under Art. 16 of the Law of the Russian Federation "On Protection of Consumer Rights". And more specifically, the actions of a financial organization are contrary to paragraph 2 of Art. 809 of the Civil Code of the Russian Federation.

If an entrepreneur takes funds for entrepreneurial activities, then this item can be canceled under Art. 165 of the Civil Code of the Russian Federation. When the client sees this information in the contract, he can demand its exclusion. Moreover, the law allows you to file a complaint with Rospotrebnadzor. The consumer should attach a copy of the loan agreement, and in the complaint indicate a request to bring the bank to administrative responsibility (Article 14.8 of the Code of Administrative Offenses of the Russian Federation).

When do you need to claim a refund?

This question should concern only those who have paid the debt ahead of schedule. Why is that? In fact, all banks operate on an annuity loan payment scheme. It is familiar to most people. Although the debt can be paid according to a differentiated scheme. You need to apply for a refund after the full payment of the loan.

Formation of overpayment

It is not difficult to understand how to return overpaid funds. To do this, you need to familiarize yourself with the principle of calculating the annuity. The following algorithm works:

- The debt is charged at the rate specified in the contract.

- Charges are added to the debt.

- The amount received is divided by the number of months.

- Each month the borrower pays one amount.

- All payments consist of the debt and the rate.

To equalize payments in the first months, customers pay minimum payments. And most of it is betting. If the debt is paid earlier, the bank will receive part of the funds received in advance. The calculation of the overpayment is carried out by an online calculator and manually.

Recalculation

Is there an early payment recalculation? Modern banks use the annuity method of payment in equal installments. At first, they mostly pay interest on the loan for the entire period of use, and small size payments - the repayment of the debt itself.

The schedule set by the bank is considered the middle option, which suggests that there will be no early payment, delays in payment. The return of interest on a loan in case of early repayment involves recalculation, after which the funds are transferred to the client.

How to return the insurance?

Often, along with a loan agreement, an insurance agreement is also drawn up. Banks do this to reduce their own risks. There will be additional costs for this document. The bottom line is that insurance is paid from credit funds throughout the entire period.

But with the payment of the debt, there is no need for insurance. By law, the money must be returned. Usually, the amount that was paid for the unused credit time is reimbursed.

To return the unused part of the insurance you need:

- Contact a bank or insurance company with a statement. A sample of such a document can be taken from employees.

- Provide documents (passport, contract, certificate of debt closure).

- Wait for the application to be reviewed and decided.

- Get funds.

Before submitting an application, you need to familiarize yourself with the contract concluded with the insurance company. It specifies the conditions for termination and refund. If nothing is said about the return of funds, then this will not work.

The procedure for early payment of the loan is not complicated and does not take much time. Although the bank does not benefit from such a deal, it is free. After that, the loan agreement ceases to be valid between the parties, and this is confirmed by a special certificate.

Terms

Are there conditions for early repayment of a consumer loan? Sberbank and other financial organizations work according to certain rules. Borrowers can repay the loan at any time, this does not require the permission of the bank. But you should notify about it one month before the expected closing date.

Early payment at Sberbank can be made using the Sberbank Online system. But it is possible to apply to a bank branch with a passport. The application must indicate the amount, the account to which the money will be transferred, and the date of the transaction. The day of early payment must be a working day.

Illegal enrichment

With early payment of the debt, it is required to determine the difference between:

- The amount of the borrower's overpayment for using the loan under the agreement.

- The amount of the cost of using the loan.

With early payment between the 2 amounts, there will be a difference not in favor of the client, since the monthly payments took into account the use of funds by the borrower during the period of the contract. Therefore, it is required to determine the monthly amount of use under the agreement and actually, and then multiply by the number of months during which the funds were used. The difference between these indicators is the amount that is returned to the borrower.

Payment

The loan repayment calculator will allow you to correctly calculate the amount of funds that must be returned. Such a service is available on the websites of many banks. You must enter the amount, term, rate, type of payments, date of receipt. After that, click the "Calculate" button.

In the calculator for early repayment of the loan, you need to enter the data specified in the contract. Only then will it be possible to calculate accurate data. Full and partial early repayment of the loan in Sberbank and other financial institutions is carried out after the client's request.

Actions

Payments for early repayment of the loan are possible only if the client goes through a simple procedure:

- It is necessary to apply to the bank with an application for payment of the entire amount within 30 days before the scheduled settlement date.

- Then you must pay the entire amount of the debt before the due date.

- You should take a certificate from a financial institution that confirms the absence of debt. These papers are provided free of charge.

- It is necessary to calculate the overpaid interest in case of early repayment of the loan using a loan calculator.

- You need to apply for a refund.

- It is important to wait for the payment or go to court if there was a refusal.

To make a refund, you need to provide a copy of the contract and a certificate of payment. You also need a client's passport.

Drawing up an application

If there was a full early repayment of the loan, you must write an application. Their forms are usually available in financial institutions. If they are not, then the application can be made in free form. There you need to specify:

- Passport data and the name of the institution.

- Contract number and date of signing.

- Agreement settings.

- Date and amount of payment.

- Information about closing a debt.

- The amount of the interest calculation.

- Request for a refund.

- Details to which funds will be transferred.

- Notification of going to court in case of refusal.

- Signature and date.

Only then is the recalculation of interest on early repayment of the loan. Judicial practice shows that most cases are resolved in favor of borrowers. It is only necessary to correctly state all the requirements in the application and indicate references to laws.

Partial payment

Early payment is considered a great advantage for the client. The borrower removes debt obligations, saves on interest. Even if this is partially done, the debt is still reduced.

The disadvantages of early payment will be noticeable when the national currency depreciates. Then it is more profitable to invest additional funds in the purchase of foreign currency in order to pay a large amount with its rise in price. But many banks tie the rate to the rate of the Central Bank. Then, with the devaluation of the national currency, there is an increase in payments.

Before making a decision on early payment, you need to familiarize yourself with the contract. It is necessary to calculate what will be the savings for this operation. You need to check the balance on the loan after the operation is completed. It is necessary to control the accrual of interest, they are calculated on the basis of the amount of early payment.

reference

After the full early repayment of the loan, you can request a certificate from the bank. It contains information about the loan: amount, term, date of payment. It is indicated that the account is closed and an addition is made that there are no claims from the bank. It is provided a few days after the application is submitted. Some banks can issue a certificate on the same day.

This certificate must be obtained even if the refund will not be made. It is proof that there is no debt. There are also technical failures and other problems. If, for example, the account is not closed or the debt is not fully written off, then interest continues to accrue on it. Over time, due to the lack of payments, penalties and fines are accrued, so the balance can become large. To avoid this, you need to contact a bank specialist and make sure that the account is closed.

Return

After submitting the application to the bank employees, the borrower can expect a positive decision. If agreed, the funds are transferred in the way that is fixed in the application. Refusals must be made to the court. Then it is more likely that the case will be resolved in favor of the client, because the law clearly defines the rules for overpayment for using the loan.

Although the law establishes that the difference between the actual and contracted amount is compensated to the borrower, credit institutions often refuse to pay the funds. Therefore, the borrower needs to know about the possibility of return and the rules for claiming money.

The influence of the middle name on the name Yuri

Name Ilya - meaning and contraindications

Baby keeps crying

What does the name Aidar mean, the mystery of the name

Name Ilya - meaning and contraindications