What factors influence the costs of monitoring and preventing opportunism within an organization to increase as it grows? After all, it would be an unacceptable simplification to talk about direct proportionality between intra-company costs and their size. Main selection factors optimal contract for a specific transaction are:

1) the degree of specificity of the assets in relation to which transactions are made;

2) the degree of uncertainty accompanying the implementation of the contract;

3) the degree of risk appetite of the parties to the contract;

4) degree of complexity of the transaction;

5) the ratio of the cost of access to the law and the cost of extralegality.

Asset specificity

Let us recall that assets are called specific if the maximum effect from their use is achieved within the framework of a given contract. Consequently, any change in the composition of contract participants will lead to a decrease in its effectiveness. “The specificity of an asset depends on the ease with which alternative uses and alternative users can be found for it.” without damage efficiency of its use" 36. There are six types of asset specificity.

1. Site specificity arises in situations of limited mobility of assets in space: natural resources, favorable economic and geographical location.

2. Physical asset specificity: investment in equipment to produce a specific component.

3. Human asset specificity: consists in a person’s possession of special knowledge and skills necessary to perform certain operations.

4. Trademarks (trademarks) 37.

5. Specificity of investments in production infrastructure, designed for the needs of a specific consumer.

6. Temporal specificity of assets, which is a variant of technological specificity: the need for a particular resource arises at a certain point in time.

Specific asset (resource) – an asset whose maximum effect is achieved within the framework of a given contract. It is difficult to find a replacement and alternative use for such an asset.

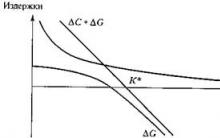

Increasing the degree of asset specificity increases the incentives to violate the terms of the contract and increases the attractiveness of using power relations as a guarantee of contract performance. This dependence is presented graphically in Fig. 16.2 38.

Rice. 16.2

In a similar way, we can depict the boundary between the firm and the market, taking into account the degree of specificity of assets (Fig. 16.3) 39 . Here C – the difference in production costs in the case of production within the company and the costs of purchasing identical products on the market (cost savings are possible in the market due to aggregation of demand, economies of scale of production), G– the difference between management costs within the company and purchases on the market, K*– the degree of specificity of assets at which it becomes more profitable to carry out a transaction within the company (the “border” of the company).

Fig: 16.3

Uncertainty

As uncertainty increases and, consequently, the need to adjust the terms of the contract, the attractiveness of the implicit contract increases and the attractiveness of the classical contract decreases, which is explained primarily by the dynamics of the costs of concluding a contract. The dynamics of the efficiency of a neoclassical contract has a nonlinear form. When the degree of uncertainty is low, there is no need to revise the provisions of the contract when it is renegotiated. On the other hand, the high probability of “shocks” in market conditions makes two- and three-party agreements ineffective: when the prospects of the business as such are called into question, it is difficult to take care of the interests of the partner (Fig. 16.4).

In the interval, the classic contract is most profitable, [ A, B] – neoclassical, [ B, +] – implicit. Now let us reflect the influence of two factors, the degree of asset specificity and the degree of uncertainty, in Fig. 16.5 40, where the vertical is the degree of uncertainty, and the horizontal is the degree of asset specificity.

Figure 16.4

Rice. 16.5

Risk appetite of the parties

The following can be said about how the degree of risk appetite of the parties to the contract influences the choice of the optimal form of the contract. If both parties to the contract are equally risk neutral, then it is best for them to enter into a classic contract. If one of the parties is neutral to risk, and the other is its opponent, then the optimal option is an implicit contract (the risk opponent becomes an agent). Finally, in other cases it is more profitable to enter into a neoclassical contract.

Transaction complexity

The complexity of a transaction refers to the structure of the transaction (how many and what powers are exchanged by the parties, for what period) and the associated amount of information necessary to specify the terms of the transaction. For example, the simplest transaction involves the purchase and sale of a standard product with payment for cash at the time of transfer of the product to the buyer. The influence of the degree of transaction complexity on the choice of the optimal contract can be represented in the form of the following heuristic model. The attractiveness of a classic contract monotonically decreases as the complexity of the transaction increases, because all its details should be explicitly fixed in the contract. Despite the optional definition ex ante within the framework of an implicit contract, it is not suitable for concluding transactions that involve the use of complex risk sharing schemes and complex configurations of distribution of powers between participants. The limiting factor is the obligation of the agent to transfer the right of control over his actions to the principal. Consequently, the most complex transactions are best concluded on the basis of neoclassical contract law (Fig. 16.6).

Rice. 16.6

The price of access to the law

Only the costs of concluding a classical contract directly depend on the price of access to the law: only this contract presupposes an exclusively judicial procedure for the parties to protect their interests and an exclusively legal mechanism for imposing sanctions. Therefore, the more effective the activities of state law enforcement agencies, the more attractive the classic contract. On the contrary, when the costs of access to the law are high compared to the costs of extralegality, the optimal choice will be an implicit contract, a kind of judicial and law enforcement system in miniature. Finally, the attractiveness of the neoclassical contract practically does not depend on the comparative value of the price of access to the law and the costs of extralegality. More precisely, this influence is not possible to determine heuristically, because such a contract combines elements of both legal and extralegal systems of property rights (Fig. 16.7).

Enterprise size- this is its size, degree of development. The size of the enterprise has a decisive influence on its activities, in connection with which it is necessary to take into account the main organizational and economic advantages and disadvantages of enterprises of different sizes, as well as keep in mind the relationship between the development of entrepreneurship and the development of an effective market strategy for the TP, based on the scale of its operation.

Individual characteristics of the optimal size should be understood as the following values:

The number of factors of production acquired during a certain period;

The number of production factors used for a certain period;

The quantity of products produced over a certain period;

The amount of money spent over a certain period;

The existence of a specific organization;

Use of a specific location, etc.

Large trading enterprises are the strongest from an economic point of view, as they have powerful financial, economic and property potential, a high level of competitiveness, and relatively low distribution costs. They can conduct marketing research, advertising campaigns, implement their own pricing policy, have a wide distribution network for selling goods and direct contacts with manufacturers. However, such firms are not always dynamic in the business environment; they are inert in the development of economic strategy, have a cumbersome management structure, and the material incentives of proactive employees and the enterprise as a whole have little connection with the final result of the work. Medium-sized trading enterprises operate, as a rule, within a narrow market segment and satisfy specific requests for the sale of goods of a certain range. They have distinctive features of the trade and technological process, their products have unique characteristics and are aimed at regular consumers. All this protects such enterprises from competitors, allows them to maintain fairly high prices and ensures financial stability. Their entrepreneurial activity is higher than in large ones, since a constant search for new ideas and improvement of the trade and technological process are required, but at the same time there is no wide range and the ability to switch activities to other goods. There is a risk of loss of know-how, as well as dependence on a specific supplier and an existing contingent of buyers. The term “small enterprise”, used in regulatory documentation, characterizes a TP based on the number of employees (TP – up to 100 people, micro enterprises – up to 15 people), but does not give an idea of the TP’s place in the market of goods and services. Small businesses also mean individuals conducting business activities without forming a legal entity. Small trading enterprises are best suited to satisfy those needs that large and medium-sized ones cannot fully provide. They are characterized by ease of organization in the organization of product distribution and accounting, work for the local market, high flexibility, up to a complete change in the type of activity, profile, assortment of goods, more economical use of resources, low management costs, increased capital turnover, the interest of each employee in final results of labor and other factors ensuring competitiveness. But it is small enterprises that are not protected to the maximum extent from external factors beyond their control. It is more difficult for them to get a loan and set up advertising; more funds are required to study the market and obtain the necessary commercial, scientific and technical information; It is impossible to pursue an independent pricing policy.

Industry specifics do not allow us to establish uniform optimal sizes of production and enterprises for all industries.

In each industry, the size of enterprises should be determined by the optimal size of production, conditions of transportation of raw materials and finished products, and a number of other factors related to the location of the enterprise.

Optimal production volumes in industry should be understood as those that ensure the fulfillment of concluded contracts and obligations for the production of products (performance of work) on time with a minimum of reduced costs and the highest possible efficiency.

In each specific industry there are optimal sizes of enterprises, objectively determined by the mechanism of formation of the economic effect of concentration from the combination of optimal production with the conditions and factors of the organization and location of production in a given industry. For example, in the shoe industry, a medium-sized enterprise typically has a sewing flow of 1 million pairs of shoes per year. The optimal size of a shoe factory is considered to be 3–4 flows. For some industries, the size of the enterprise is influenced by the transportability of the product. Supplying bricks further than 200 km from the plant is not profitable, because transportation costs after 200 km increase by 20%-25% for every 50 km. Therefore, the brick production capacity should not be 40 million pieces per year.

Certain industries also have their own specific factors that influence the size of production and enterprises. For example, in industries that process agricultural raw materials, such factors as the density of the raw material and the permissible radius of its delivery are important.

In the domestic literature, there are two approaches to determining the optimal size of an enterprise. The first approach is associated with minimizing the reduced costs of production.

The optimal size of the enterprise is considered to be the one at which the minimum reduced costs are achieved.

Rice. 1. Dependence of total costs on production volume: A – internal production costs for production; B – non-production costs; P – total costs of production and sales of products.

There is also a known graphical method for determining the optimal size of an enterprise, the essence of which is shown in rice. 1. This shows the dependence of intra-production costs (A), non-production costs (B) and total costs (P = A + B) on the volume of output. The optimal enterprise size is achieved with a minimum of total production costs. In the figure, this minimum is indicated by point K.

In Western literature, the optimal enterprise size is determined by comparing the positive and negative economies of scale in production. Instead of optimal enterprise size, the concept of minimum enterprise size is used .

A consistent increase in the size of an enterprise over a period of time entails a reduction in the cost of producing a unit of output, but, starting from a certain point, larger and larger enterprise sizes mean an increase in average total costs. This pattern should be explained using what economists call positive and negative effects of increased scale of production, or scale effects.

Positive economies of scale are the effects of mass production or economies of scale. As the size of an enterprise grows, a number of factors begin to act in the direction of reducing average production costs:

1. Specialization of labor. The possibility of dividing labor operations, provided by the increase in the scale of production, allows workers to gain especially great experience in performing specific tasks assigned to them. By being able to focus on one task at a time, a worker can be much more productive. Finally, a higher level of labor specialization eliminates the loss of time for a worker to move from one task to another.

2. Specialization of management personnel. Expanding the scale of operations will mean that additional specialists will be involved to perform all management functions. Ultimately, this will lead to increased efficiency and lower unit production costs.

3. Efficient use of capital. Only large manufacturers can afford to purchase and effectively operate the best equipment.

4. Production of by-products. The organizer of large-scale production has greater opportunities for producing by-products than a small firm

All of these technological factors will contribute to lower unit costs for those manufacturers who are able to scale up their operations. However, over time, the expansion of the firm may lead to negative economic consequences and, therefore, to increased unit production costs. The main reason for the emergence of diseconomies of scale is associated with certain managerial difficulties that arise when trying to effectively control and coordinate the activities of a company that has become a large-scale manufacturer.

The fact that there is an optimal size for efficiency does not mean that growing firms are doomed to become inefficient. Technological or even managerial diseconomies of scale do not necessarily limit the size of an association as they do the size of an individual enterprise: processes can always be duplicated when they become inefficiently sized. Even if there is an optimal output level for each of a firm's plants and production lines, it may not exist for the firm as a whole. Moreover, even if a multi-plant firm is too large to maximize efficiency in the use of a given amount of resources, it may not be able to achieve efficiency through decentralization without some positive growth rate.

Over a long period of time, all desired changes in the structure of resources can be undertaken both by the industry and by the individual firms that comprise it. The firm can change the scale of its production capacity. It may install additional equipment or retain less equipment. In fact, in many industries the number of possible plant sizes is completely unlimited. If the long-run cost curves of firms in any industry are horizontal, the size of the firm is indeterminable. If the size of each firm is indeterminable, the same can be said about the number of firms in the industry, which raises doubts about the large number of firms required for a situation of perfect competition.

To understand this issue, it is useful to use the concept of minimum effective size. It is simply the smallest level of production at which the firm can minimize its long-run average cost. This becomes possible with a production volume equal to q 1 (Fig. P. 15.1). Due to the length of the segment of the graph corresponding to constant returns to the growth of production scale, it is noticeable that a firm producing a significantly larger quantity of products also ensures minimum average costs. Strictly speaking, within the interval q 1 q 2 all firms turn out to be equally efficient.

It is worth comparing this with a situation in which positive economies of scale are longer lasting and negative economies are relatively distant (Fig. P. 15.2). In this case, the long-term average cost curve will decrease over a significant segment of the horizontal axis (corresponding to an increasing increase in production volume). This means that for a given volume of consumer demand, sufficient production efficiency will be achieved by only a small number of industrial giants. Small firms will not be able to provide the minimum efficient size of production and will not be viable.

If positive economies of scale are small and negative economies occur very quickly, the minimum efficient size is determined by the small volume of production (Fig. P. 15.2). In these types of industries, the existing volume of consumer demand will support the existence of a significant number of relatively small producers .

From the above it follows that the shape of the long-term average cost curve, depending on positive and negative scale effects, can be of decisive importance for the structure and level of competitiveness of a given industry. Whether an industry is “competitive” (composed of a relatively large number of small firms) or “concentrated” (dominated by a few large producers) depends on the technology used in the industry and the resulting shape of the long-run average cost curve. Reducing production costs means that existing large firms, with the help of low prices, can ruin small ones and block the formation of new firms, thus imposing monopolistic control over world markets. Economies of scale are among the most important determinants of trade patterns in agriculture, where large agribusinesses in developed countries can use low prices to put pressure on low-productivity family farms in developing countries. Economies of large scale enable it to exercise monopolistic and oligopolistic control over international supply conditions, just as it does in its domestic markets for a wide range of products. Moreover, this process of establishing market dominance of control is largely irreversible. The economies of countries that initially found themselves lagging behind simply cannot compete with giant corporations.

Small businesses exhibit a relatively high ability to survive. Many of them cannot withstand the competition and close. However, many small businesses continue to operate successfully. The most important reasons for their sustainability are: flexibility, narrow specialization of production, the use of modern microprocessor technology, government assistance to small businesses in terms of financial resources, preferential taxation, and scientific consulting.

Large firms, unlike small ones, have the opportunity to carry out mass standardized production, as well as expand the scope of their activities. However, as the company grows in size, management flexibility decreases. In this regard, an optimal combination of enterprises of various sizes is necessary.

The size of enterprises is influenced by various factors, which are divided into: national economic, industry and intra-industry (specific).

National economic factors include technical progress in the national economy - electrification, chemicalization, improvement of equipment and technology in industries that provide each industry with means of production and objects of labor.

Regional differences often influence the concentration of production. For example, the size of an enterprise and its technical and economic indicators depend on the availability of labor resources, sources of water, fuel, and electricity.

The concentration of production in various sectors of industry and agriculture is influenced by industry factors. Some promote their development, others hold them back.

Thus, in the food industry, the consolidation of enterprises is facilitated by the successful development of agriculture, namely: growth in acreage, productivity, gross harvest, density of state procurement of agricultural crops, growth in livestock and animal productivity.

The increase in the size of enterprises is significantly influenced by the growing demand for the products of a given enterprise.

Intra-industry (specific) factors are associated with the special properties of raw materials and finished products. For example, tomatoes and green peas, cakes and pastries cannot be stored for long periods of time. In this regard, the capacity of workshops and enterprises producing perishable products must be designed to serve a small area (district) and have a minimum delivery time.

The factors listed above influence the level of concentration of production, and therefore the size of any enterprise. Some of them restrain, while others promote its growth. Therefore, planning the concentration of production consists of finding the optimal (most profitable) enterprise size from an economic point of view. The latter must ensure minimal costs for construction or reconstruction, production of products and delivery to the consumer.

It should be remembered that the process of concentration develops dialectically. This means that the size of the enterprise depends on specific conditions and time. Therefore, the concentration of production is closely related to its location. Based on the above-mentioned advantages and disadvantages of production consolidation, data on costs in small, medium and large-scale production, the optimal size of the enterprise can be determined.

The methodology for determining the optimal size of enterprises is based on establishing a quantitative relationship between capacity growth and the level of production costs.

All costs associated with changing the size of an enterprise can be divided into three groups:

1) costs per unit of production, which, regardless of the size of enterprises (operating under comparable conditions), remain unchanged (for example, the cost of raw materials and basic materials, auxiliary materials without delivery costs);

2) costs per unit of production, which increase as the size of the enterprise increases (transport costs for the delivery of raw materials and losses);

3) costs per unit of production, which decrease as the enterprise increases (costs of fuel, water, energy, wages, depreciation due to a decrease in specific capital investments, costs of current repairs and maintenance of buildings, structures, equipment).

An analysis of changes in technical and economic indicators with an increase in the size of enterprises showed that these indicators improve only up to certain limits (up to a certain size of the enterprise). With further growth in the capacity or size of the enterprise, these efficiency indicators do not change or worsen.

First, the lower and upper limits of the optimal enterprise size are determined, and then the most effective option for optimizing and locating the enterprise.

Scientific and technical progress and improved organization of production change the upper and lower boundaries of the optimal size in both directions.

The optimal size of an enterprise in any sector of the national economy is considered to be the size that ensures the minimum total costs for the delivery of raw materials, construction of the enterprise, production of products and delivery to the consumer.

The minimum total costs are calculated using a slightly modified reduced cost formula:

Where Ts, Tg.p . – respectively, transport costs for the delivery of raw materials and finished products, rubles;

C – total production costs without transport costs, rub.;

Yong – standard coefficient of efficiency of capital investments;

TO– capital investments for the construction of the enterprise.

The formula for reduced costs makes it possible to quantify and take into account in the calculations most of the positive and negative aspects of production concentration and to simultaneously compare capital investments and current production costs. The optimal of all options is considered to be the one for which the value of the reduced costs will be the smallest.

factors: quantity and quality of existing equipment; the maximum possible productivity of each piece of equipment and the throughput of areas per unit of time; accepted operating mode (shift, duration of one shift, intermittent, continuous production, etc.); nomenclature and range of products, labor intensity of manufactured products; proportionality

factors production at the enterprise are: means of labor, objects of labor and personnel. The main role belongs to the human resources potential of enterprises. It is the personnel who play the first violin in the production process; it depends on them how effectively the means of production are used in the enterprise and how successfully the enterprise as a whole operates. Therefore, every enterprise must

factors, which influence the reduction of production and sales costs. The content and essence of a comprehensive program to reduce production costs depend on the specifics of the enterprise, the current state and prospects for its development. But in general terms, it should reflect the following points: a set of measures for a more rational use of material resources (implementation

factors. To internal factors include: acceleration of scientific and technical progress, level of management, competence of management and managers, competitiveness of products, level organizations production and labor, etc. To external factors which do not depend on the activities of the enterprise include: market conditions, price levels for consumed material and technical resources, useful life

factors; setting the final price. Selecting and evaluating an enterprise's pricing strategy is a complex process that requires a lot of attention and collective effort. By making a choice, the enterprise thereby gives preference to one or another development option. Meanwhile, each direction of development has its pros and cons. For example, an enterprise’s adoption of a strategy to increase

factors production and innovation - reflect various functional aspects of business activities and are considered as its characteristics. Entrepreneurial initiative is of an economic nature and is associated with the presence of market uncertainty and economic freedom. In this sense, it should be considered not as a property of human nature, but as

factor a. Innovation is something perceived as new, as innovation. Innovation is a process during which an invention or discovery is brought to the stage of practical application and begins to produce an economic effect, a new application of scientific and technical knowledge, the introduction of a new production method or the use of a new form organizations businesses that ensure market success, launch in

factors and development of activities that weaken or neutralize their negative impact to the maximum extent, or use the positive impact of these factors to successfully solve strategic problems; ? adaptive nature - the ability to anticipate changes in the external and internal environment and adapt functioning to these changes organizations. Strategic planning is a process

factor business protection. Strategic methods of protection include mainly measures organizational and managerial nature: building a corporate structure (structure organizations, included in the holding, group of companies), formation of an internal control system, organization effective motivation system for top managers, etc. Tactical methods of defense are used when

factors I determine the general scale of demand and supply of monetary goods, their structure. The supply of money depends on the scale of economic activity, its efficiency (profitability), the level of monetary income of the population, the structure of their spending and other factors. The greatest influence on the volume of money supply is exerted by two sources - the funds of enterprises stored on

Paris: modern architecture

Japanese and Russian New Year haiku and tanka

Is the contract subject to taxes and fees?

Accounting info Instructions for establishing workwear in 1c

Dream Interpretation: Why do you dream about a dead person alive?